About Us

Our team genuinely love design, development and strategy for online success.

Our Services

Our team of experts will guide you through your project using the following services.

We were lucky to have Gary Rohloff, Co-founder and Managing Director at Laybuy on Talk’n Shopify this week. Gary shared his incredible journey about how Laybuy transitioned from a family dinner-table discussion to being listed on the ASX and having 12,500+ merchants in 3 countries just 4 years later. Their UK business alone grew 500% throughout the year 2021 and is one of the top 3 BNPL providers in the UK market.

BNPL is a lifestyle enablement tool for consumers of the 21st century to help manage budgets and provide an alternative to credit cards. It allows consumers to immediately purchase and get their hands on a tangible product, but delay the payment until a later date. Laybuy pays the retailer on the consumer’s behalf, and the consumer pays Laybuy through six equal weekly interest-free instalments.

Watch or listen to this episode with our eCommerce experts to find how you can utilise the BNPL model to drive sales both in-store and online.

Laybuy’s retailers have experienced AOV increases from 15% to over 200%. A highlight is one UK retailer had an AOV online of just £6 before installing Laybuy and now it is £42 through Laybuy. Overall Laybuy is seeing a 30-40% uplift in AOV – not a bad return for minimal effort from retailers!

Laybuy Global is the only BNPL model that allows consumers to pay in one currency and merchants to receive payment in another.

You can use your channel both in-store and online, including reporting directly from web to store. The in-store contribution to Laybuy sales is currently about 30%.

4. Laybuy Tap to Pay

4. Laybuy Tap to PayThis means consumers can load their Laybuy cards to their smart phone wallet and simply tap it in store to complete their weekly payments. There is no additional integration for the retailer, as long as you provide Laybuy with your Mastercard Merchant ID. Laybuy offers direct integration to POS as well as providing in-store collateral.

Laybuy offers weekly payments compared to competitors who offer fortnightly and monthly. This isn’t a coincidence, Gary and the team analysed consumer trends for budgeting and spending cycles. Consumers budget their discretionary spend and can use the BNPL model in a range of industry verticals from fashion outlets to event ticketing platforms. Laybuy Boost also allows consumers to spend more than their Laybuy limit in one transaction provided you pay excess to limit today.

And what’s even better news, there’s more to come! Laybuy have some exciting new features to come so watch this space.

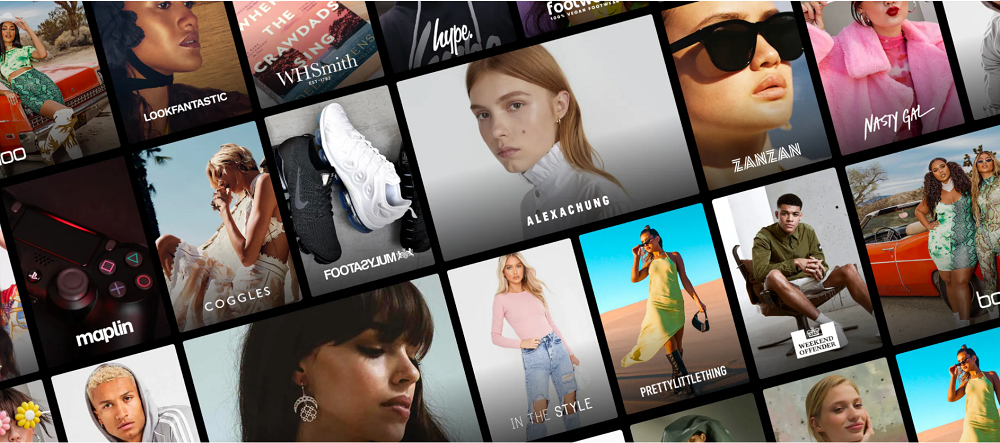

Laybuy is integrated with all the major web platforms, including Shopify and their API’s make bespoke integration easy too. If you are serious about increasing your consumers’ flexibility email merchant@laybuy.com and the Laybuy team will help you straight away.